Employee Health and Safety Insurance (Seguro de prevención de riesgos laborales) is one of those regulations that many business owners are not aware of and/or have not been made aware of by their advisors but it is another way you can be tripped up as a business owner if you are not careful or aware of the risks.

In a bid to better control the exact amount of hours employees really work, the Department of Work Inspections and Social Security has amended its system once more. Up until now, it was only obligatory to keep records for employees on part-time contracts but their 2016 Plan now includes full-time contracts also. So, what is behind these changes? What obligations do employers now have? What consequences are there if strict records are not kept?

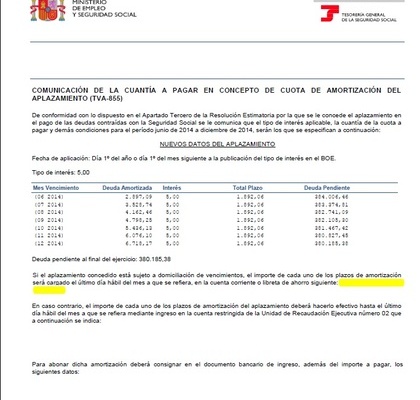

If a business owner falls behind with their obligations to Social Security, the Administration can adopt measures necessary to recover the outstanding debt but there are also steps debtors can take in order to settle the debt themselves.

Employees form an essential element of many businesses, as without them, certain companies would simply not be able to function. Business owners have other responsibilities towards their employees besides payment of their salary, namely payment of Social Security on their behalf each month.

DECISION (EU) 2016/344 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 9th March 2016 on establishing a European Platform to enhance cooperation in tackling undeclared work

This matter goes as far back as 18th April 2012 when in a communication entitled, ‘Towards a job rich recovery’, the Commission highlighted the need for improved cooperation among Member States and announced the launch of consultations on setting up a platform at Union level between labour inspectors and other enforcement authorities to combat undeclared work, aimed at improving cooperation, sharing best practices and identifying common principles for inspections.