If a business owner falls behind with their obligations to Social Security, the Administration can adopt measures necessary to recover the outstanding debt but there are also steps debtors can take in order to settle the debt themselves.

- Measures Initiated by the Debtor

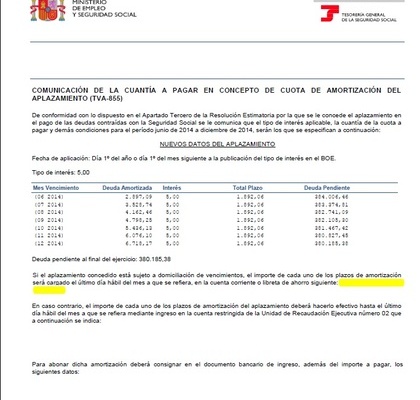

The debtor can apply for a deferment of debt to include interest accrued as long as the debtor qualifies but there are certain concepts the Administration will not allow to be paid in installments like amounts due for work related accidents or professional illness for example.

There are a number of forms that must be submitted to apply for deferment of debt:

- TC 17/10: Request for deferment of debts with Social Security

- TC 17/11: Acknowledgement of debt with Social Security

- TC 17/12: Request for payment by means of standing order

- TC for amounts not covered by payment in installments

- TC for amounts that are covered by payment in installments

- TC-2: Summary of employees

The application must cover the full amount owed to Social Security and if necessary, the debtor may be required to provide guarantees. The most common way is in the form of a bank guarantor by a legally recognized entity in Spanish territory but if this were not a option, a second mortgage, guarantee insurance policy or any other guarantees sufficient enough to cover the total debt plus interest. Said guarantee if accepted should be recorded in the Guarantor Registry. If a property is to be used as collateral, the corresponding evaluation should be submitted also and any other financial information deemed necessary.

Once the application has been submitted, Social Security has three months in which to respond. Bear in mind that deferment of debt won’t be granted if the amount owed is inferior to 3.000 euros and that if payment by installment is granted, the repayment period may not exceed five years. If the applicant had previously requested deferment of debt and it were not honoured, the Administration will not grant a new one. Any applications for deferment will also be rejected if the sale of seized property has already been authorized.

Deferment will be considered null and void if the requested guarantees were not submitted within the stipulated deadline. The Administration will automatically cancel the agreement if the debtor does not remain up-to-date with payment of any new, monthly contributions or does not honour the agreed repayment of debt and will proceed to execute the constituted guarantees in order to recover the debt that way. Any unpaid interest to date will be demanded and the debt will be recalculated.

- Measures Initiated by the Administration

The Treasury Department of Social Security selects debtors when the amount due is in process of action of debt and requests information regarding the existing balance in their bank accounts. This can be done at any bank where the debtor’s name is registered as account holder or joint account holder and the banks in turn have thirty days in which to confirm the information. Social Security can then initiate the embargo on bank accounts and the banks are obligated to retain the funds for a ten-day period, in which the procedure is double-checked. If everything checks out after ten days, the embargo can be executed and the bank then has seven days in which to deposit the funds in Social Security’s bank account. The debtor’s file is verified once more and the information is filtered through the various departments at Social Security. An official Commission exists to confirm any procedures that have been executed to ensure it has been followed to the letter; this Commission must meet periodically, at least every 6 months.

The Administration may also proceed to embargo other assets such as vehicles and property in order to recover their money.

As a business owner, always ensure to stay up-to-date with obligations to Social Security because the consequences can be detrimental. If a business owner were to fall behind, it is obviously in their best interest to approach Social Security first to settle the outstanding debt, before it takes matters into its own hands.