Following on from yesterday’s email, Royal Decree-Law 8/2020 was published yesterday to complement Royal Decree 463/2020, 14th March.

The chain reaction the outbreak of COVID-19 as caused throughout the world that initially concentrated in China, interrupting much of the world’s production and manufacturing output has now filtered down to other dependent sectors, affecting export and supply.

We have also seen the direct impact it is having on domestic finances, the closure of schools, the cancellation of public events, flight and other transport bans that have primarily shaken the tourist industry, not to mention the effect on the global stock market. The limitations imposed on us since last Saturday have meant restrictions on freedom of movement, quarantine which have generated incredible issues within the family unit and businesses alike, especially for those families whose income derives from the type of activities that have been temporarily banned by the government.

The government’s priority right now is to minimize as much as possible the impact of this lockdown and facilitate measures to ensure we can all bounce back as soon as the situation improves.

Some of you emailed me yesterday about the new situation and as mentioned in my previous email, I spent the day reading through and clarifying certain points of the decree that were not so I can summarize its key points to you. If after reading this email, you still have queries or concerns about your situation, please do not hesitate to contact me again. Since there has been no official has been published about Holiday Lets, the only thing I will say at this time is that there is a difference between the types of accommodation being mentioned (hotels, camping and caravan sites…) and self-contained units such as private apartments and villas. Hotels and similar call for groups of people to be attended to in the dining area for example as the rooms are not self-sufficient, so this closure may only refer to these types of accommodation. This is not official as mentioned, only my own deductions, however, if your property is currently occupied, remember, the government is encouraging people to return to their countries of residence until this crisis is resolved mainly because airspace is due to be closed down or greatly reduced.

According to this Royal Decree-Law, the following measures have been approved:

1.- Extraordinary Social Security benefits for closure of business activity for those affected by the declared State of Emergency in order to regulate the health crisis produced by COVID-19:

a) Exceptionally and limited to one month1 from the date in which Royal Decree 463/2020, 14th March came into effect when the State of Emergency was officially announced, those sole traders whose business activities were shut down have the right to these “unemployment” benefits as long as the following criteria is met:

- To be affiliated and currently registered as a sole trader (Régimen Especial de la Seguridad Social de los Trabajadores Autónomos) or at least on the date the State of Emergency was announced (14th March 2020)

- In the event, your business activity was not directly shut down by virtue of the above-mentioned Decree, you must provide evidence that your billing during the month prior to applying for unemployment benefits has been greatly reduced by at least 75% in comparison to the average billed over the six previous months

- To be up to date in payment of all Social Security contributions. If this is not the case, they allow a maximum of 30 days in which to make these payments and access unemployment benefits

1 Unemployment benefits would be extended to the last day of the month in which the State of Emergency concludes, should this situation last more than one month

b) The benefit amount is calculated by applying 70% of the average base rate you have paid over the last twelve months, which is to say, twelve consecutive months and immediately prior to applying. If the applicant has not been registered as self-employed for twelve months, therefore not meeting the normal criteria, the benefit amount applicable would be the equivalent of 70% of the minimum base rate

c) As stated, the duration of this extraordinary benefit is one month, which could be extended to the end date of the State of Emergency, however, this time would be recorded as if you had continued paying into the system as normal, i.e., it does not interrupt your registry as self-employed and it does not reduce the time you may receive this same benefit if you have to apply again in future (for a situation unrelated to COVID-19

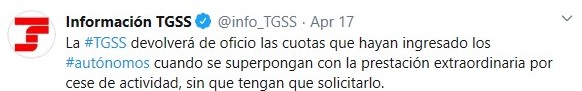

d) Receipt of unemployment benefits mean you would not be liable to pay Social Security contributions. For those who continue their business activity, you must pay the monthly contribution as normal

e) Receipt of unemployment benefits is incompatible with any other Social Security benefits

f) Working partners linked to co-operatives will be granted the same rights to access these benefits as long as they meet the requirements established above

IMPORTANT NOTE: The Decree does not mention if this applies to Sole Traders registered as Family Collaborators. I am trying to find out whether they would have the right to unemployment after the principal Sole Trader applies.

2.- Measures to regulate employee contracts to avoid dismissals:

a) There is a system in place for those businesses that have suffered the most severe losses due to forces beyond their control such as this health crisis called ERTE (Expediente de Regulación Temporal de Empleo). What is the definition of forces beyond control in this situation?:

- Suspension or cancellation of business activities

- Temporary closure of premises open to the public

- Restrictions on public transport

- General restrictions and freedom of movement of people and/or merchandise

- Loss of provisions that hinder the normal development of the business

- Contagion within the company

- When extraordinary measures of preventative self-isolation have been enforced in the company

b) In the case of those businesses that on 29th February had less than 50 employees, Social Security will absorb the business owner’s obligatory payments 100%. In the case of those businesses that on 29th February had more than 29th February had 50 employees or more, Social Security will absorb 75% of the business owner’s obligatory payments. These obligatory payments referred to here DO NOT include the business owner’s own monthly Social Security contribution

c) Employees affected by the ERTE system have the right to receive unemployment even if they have not been registered employees for a full year as normally required by law

d) Businesses that choose the ERTE system are obligated to maintain all employees in the company for at least SIX MONTHS after business activities return to normal

e) Social Security must respond to the application within 5 days

f) Employees who have dependents (minors or elderly) should be permitted to take leave to see to their family in the best way possible, however, employees who are absent from their place of work for unjustified reasons may be dismissed (the proper procedure must be followed)

3.- Business Line of Credit:

The Ministry of Economic Affairs will grant a line of credit to ensure cash flow in affected companies (payment of invoices, financial or tax obligations or other cash flow issues). The maximum amount is 100.000 euros and conditions are being drafted

4.- Extensions for Mortgage Loans:

a) For those who have especially difficult circumstances due to the COVID-19 crisis and are unable to make mortgage repayments on their mortgages, special measures apply for their primary residence only

b) Those debtors that fall under the category of “economic vulnerability” as established in Article 9 of the Decree-Law (or point c of this document) and whose contracts are currently in effect. These same measures apply to guarantors of the debtors

c) Definition of economic vulnerability:

- The debtor has been made unemployed or in the case of sole traders, has suffered a substantial loss of income or a substantial fall in sales

- That the total income of the family unit does not exceed the income received in the month prior to applying for the extension

-

-

-

- In general terms, the limit of three times the monthly Indicador Público de Renta de Efectos Múltiples (IPREM)

- The above limit will increase by 0,1 the IPREM for each dependent child or 0,15 for each child in a single-parent household

- The general limit will increase by 0,1 for each family member over the age of 65

- If any family member has a declared disability higher than 33%, dependent situation or illness that does not permit them to work, the general limit will be four times the stipulate IPREM, regardless of any increases

There is still a little bit of uncertainty about some of these measures as procedures have not been clearly outlined etc., and the Administrations themselves are not entirely sure what the logistics would be, but if you would like to proceed with any of these options, please contact me to discuss how best to move forward. If not, it is business as usual until we all come out fighting the other side.

As always, take care