Over the past few days, there has been more movement regarding financial aid for sole traders and business owners. Social Security confirms that on Friday 17th April 2020, 919.173 self-employed persons received payment in what is the first outlay of benefits that amounted to approximately 670,9 million euros. On 15th April, the record shows that 1.016.670 business owners have applied for this financial aid, so there are more payments on the way in case you have not received yours yet, but congratulations to all those who have, it must feel like winning the Golden Ticket from a Wonka Bar!

One very important detail that I noticed when I received the first notification that a client’s application had been approved was that it only confirmed payment of 661,08 euros. The Central Government stated in Royal Decree-Law 8/2020, 17th March that they would pay 70% of the base rate that determines how much Social Security we pay each month, so this amount coincides with that, however, the Canarian Government said it would pay the remaining 30% to all residents of this region. The minimum base rate is 944,40 euros, so where is the missing 283,32 euros?

While I have been reading through legislation and corrections on a daily basis from the Central Government, perhaps I have not been monitoring Canarian legislation quite as closely, but to be fair, they have been pretty quiet about financial measures since announcing they would pay the balance and nothing has been reported on the news either. Also, we (other professionals and I) thought that since the Mutuas have been charged with processing Sole Trader Unemployment Benefits, this would be automatically included once they approved the application, but this has not been the case, so I’ve been investigating the matter further.

The Canarian Government published a decree that has almost gone unnoticed (you’ll find out why in a minute), Decree-Law 4/2020, 2nd April and Article 3 confirms that 11 million euros has been made available to business owners who qualify. Upon reading the decree, the following stood out to me in particular:

1. Financial Aid will cover the missing 30% of the minimum base rate. What is my query here? Well, not everybody pays the minimum rate; some business owners contribute at a higher rate, so I’m not sure if they will be paid as per their contributions or whether it will be limited to the minimum.

2. The decree refers to this financial aid as a “grant” or “subsidy”, terms that are often used to help get new businesses off the ground, but these are not necessarily “free” if you can see what I’m getting at. The Central Government uses the expression “Social Security Benefit”, so it will be interesting to see whether any strings are attached to receiving this payment or not, but it is feasible that it will be done exactly at the President of the Canarian Government announced and I am overthinking the terminology that has been used as in Spanish there are other variations of the word “grant”.

I have contacted the Canarian Government to verify the procedure to obtaining the missing 30% since it has not been automatically added to the payments received. The response I have received so far confirms that although the Decree was authorized, additional steps such as how to apply for this financial aid, conditions etc have not yet been approved, but the Canarian Government hopes to publish terms and procedure next week (not guaranteed). I am still awaiting a response with regards to my concerns, but I imagine we will have to wait until a new decree is published to find out so watch this space.

For those whose application has been accepted, you are exempt from paying Social Security contributions until the State of Emergency comes to an end. However, the Administration still has the right to verify that you qualify for these benefits, so they may require additional paperwork to confirm, but to date, 97,3% of all applications have been approved without incident.

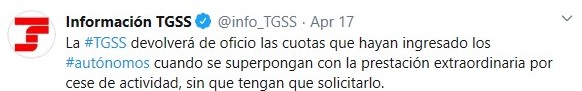

There is still one very important issue to discuss… what about Social Security contributions that were charged on the 31st March? Social Security did not implement measures prior to this date, which meant that everyone was charged a full month’s contribution, even who have had to close doors since 15th March. As mentioned in the previous paragraph, business owners in this situation are exempt. A tweet from their official account says that the contribution will be refunded without the need to apply, and further investigation indicates this will happen in the second half of May.

INTERESTING STATISTICS:

The retail sector has filed the majority of all applications (123.883) followed by the hospitality industry (112.854) and construction (68.560)

The worst affected autonomous regions are Andalucía, Cataluña and the Comunidad Valenciana.