Mayhem and more mayham as Social Security realizes the error made last month when processing payments and deductions as some sole traders renewed their right to continue receiving Sole Trader “Unemployment” Benefits whereas others opted out.

The situation is as follows… Around 250.000 business owners chose to continue receiving unemployment benefits whilst trade is still slow due to Covid-19 but many who had been receiving payments decided to discontinue either because business had picked up and they could manage without additional help or because their income forecast for summer trade would exceed the maximum permitted by Social Security to qualify for benefits.

Those who discontinued benefits would instead receive reduced rates on their Social Security contributions from June to September; now, my clients in this situation will remember when I said at the time that since it was possible to apply for continued benefits until August, it is likely Social Security would charge as normal in June and July and wait to see which business owners are still receiving payments and then deduct two months contributions at the end of August as that seemed the most logical course of action. However, this did not happen and surprisingly, Social Security implemented deductions straight away.

This is partly where the problem lies because not only did they apply deductions virtually across the board meaning that many sole traders only paid 10% of their normal monthly contribution even though they had applied to continue receiving payments; but the Mutuas correctly refunded these sole traders a percentage of the Social Security contribution as part of their benefits payment.

What does this mean? Well, not only were the affected sole traders charged 90% less by Social Security but they were also reimbursed part of the contribution by the Mutua (double whammy!) so in many cases, these business owners now owe Social Security a minimum of 250 euros depending on their base rate.

How has this happened? Social Security and the Mutuas are independent entities so the information is not picked up immediately, so Social Security did not have the necessary data to determine who was entitled to the 90% reduced rate in June. Again, this is why at the time I had assumed they would wait until the end of August before applying any deductions as they would have sufficient information by then but they didn’t do that.

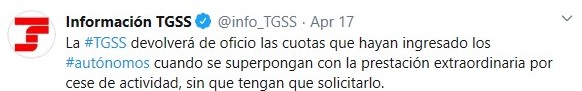

The second scenario is that other business owners are owed money by Social Security because they paid the full contribution in June when they should have only paid 10%. In this case, they must request the appropriate refund directly.

The third and final scenario is those sole traders who had been receiving benefits until May but opted not to renew this right correctly paid 10% of their normal contribution in June and will continue receiving discounts until September. In this case, the sole trader neither owes nor is owed anything.

Bottom line… Check your June bank statement to see what Social Security you paid and what you received from the Mutua to verify whether you are one of the affected business owners who now owes Social Security. If you are unsure, please contact me about it. So far Social Security has not released clear information as to how they intend on regulating these payments, but I’m sure they are working on a way to fix this big mistake!