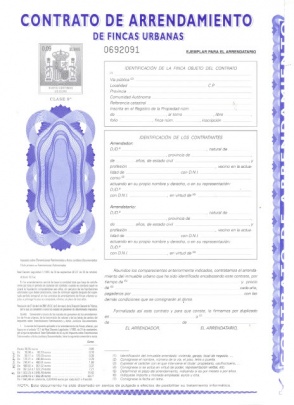

Property rental is a booming business on the island with many people subsidising their income by renting out any additional properties they may own, however, as with most matters, there are many legalities that the majority are not aware of and we are going to tackle one that is almost unheard of. Even though most contracts are drafted on regular A4 paper, some of you may have noticed upon signing your contract that stamped paper has been used but may not have really questioned the reason why.

Unbeknownst to the the average Joe Blogs, property rentals are subject to taxes, more specifically Transfer and Stamp Duty Tax (Impuesto de Transmisiones Patrimoniales y Actos Jurídicos Documentados – ITP -AJD) as per article 8 of Real Decreto Legislativo 1/1993, 24th September. The confusion here is that most associate this tax with property sales but unfortunately rentals are also included which is surprising because it is an unknown tax that even the authorities do not actively pursue despite the vast number of rentals that are carried out on a daily basis. Aside from the obvious, “why?!”, there are a few questions that immediately spring to mind that we are going to consider.

Unbeknownst to the the average Joe Blogs, property rentals are subject to taxes, more specifically Transfer and Stamp Duty Tax (Impuesto de Transmisiones Patrimoniales y Actos Jurídicos Documentados – ITP -AJD) as per article 8 of Real Decreto Legislativo 1/1993, 24th September. The confusion here is that most associate this tax with property sales but unfortunately rentals are also included which is surprising because it is an unknown tax that even the authorities do not actively pursue despite the vast number of rentals that are carried out on a daily basis. Aside from the obvious, “why?!”, there are a few questions that immediately spring to mind that we are going to consider.

Who is liable to pay this tax?

It is the tenant who is responsible for paying this tax in at the Canarian Tax Office, the reason being the tenant acquires rights to use a property for a determined period of time in exchange for money so it is considered a sales transaction subject to tax.

How much would I be looking to pay?

There is an official chart applicable on a national level but since it is a tax that each Autonomous Region is responsible for, each one can charge as they see fit even though as in the Canaries, most just stick to the below scale as found in article 12 of the above-mentioned law:

| Rental Amount | Tax to Pay |

| Up to 30,05 | 0,09 |

| From 30,06 to 60,10 | 0,18 |

| From 60,11 to 120,20 | 0,39 |

| From 120,21 to 240,40 | 0,78 |

| From 240,41 to 480,81 | 1,58 |

| From 480,82 to 961,62 | 3,37 |

| From 961,63 to 1.923,24 | 7,21 |

| From 1.923,25 to 3.846,48 | 14,42 |

| From 3.8465,49 to 7.692,95 | 30,77 |

| From 7.692,96 upwards | 0,024040 euros for every 6,01 euros or fraction |

To give you an example: The tax due on an apartment rented for 500 euros a month over a 3-year period would work out at:

500 euros x 12 months = 6.000 euros

6.000 euros x 3 years = 18.000 euros

Since 18.000 euros exceeds 7.692,96 euros shown on the above scale, you would have to calculate as follows:

18.000 euros / 6,01 = 2.995 euros

2.995 euros x 0,024 = 71,88 euros

The resulting tax to pay amounts to 71,88 euros. If the contract is renewed, the tax must be settled each year until the contract finalizes.

How do I pay this tax?

There are two ways:

- If the contract is drafted and signed on official stamped paper (papel timbrado) that can be purchased at the tax office, the cost of the paper itself amounts to the corresponding tax to pay, therefore liquidating the tax there and then, also answering the question about how the official paper fits into this transaction

- However, if the contract is drafted on regular A4 paper, you would have to liquidate the tax by means of Tax Form (Modelo) 600 and pay the corresponding amount in at the bank

As you would have already guessed by now, there are penalties that apply if this law is not followed even though as mentioned, most Autonomous Regions to not actively chase this issue, it does not mean you are not legally bound to settle the tax anyway.

This law only applies to residential property rentals and not commercial leases as these taxes (retentions and IGIC) are paid in a completely different way and on a quarterly basis.