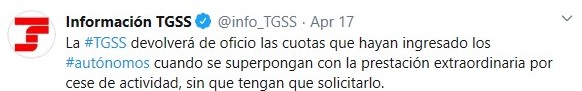

As mentioned in my article posted on the 20th April 2020, the Canarian Government approved a decree on 2nd April 2020 stating their resolve to make up the balance of the benefits payable by the Central Government for Sole Trader Unemployment. The decree published by the Central Government confirmed payment of 70% of the Base Rate paid each month in Social Security Contributions (a minimum rate of 944,40 euros) which is why most of you have received a payment of 661,08 euros so far, but when I saw the first notifications approving some of my clients applications, my first question was, what about the 30% the Canarian Government promised to pay?

Following on from my previous article, I can now say the Canarian Government drafted an Order on 21st April which was published this morning as Order 21st April 2020, BOC Nr. 82. This Order details the requirements to apply for the missing 30% of Sole Trader Benefits for those business owners who were either forced to close doors on 15th March 2020, or who have since experienced decreased income of at least 75% in relation to the average income taken over the previous six months. The main points to take away from this Order are as follows:

- A fund for an initial 11 million euros has been made available for this grant

- This grant is not automatically payable, so although you may have been notified about provisional approval from the Central Government and received the 70% payment already, this grant is only given upon request

- Only business owners whose registered tax address is in the Canary Islands are elegible to apply

- These business owners must (1) have been registered as self-employed at Social Security on the date of the State of Emergency -14th March 2020- (2) must have a business activity that was suspended by article 10 of the Royal Decree that authorized the State of Emergency (3) must have received approval via the Mutua of their right to receive the 70% payment by the Central Government, either due to their activity been automatically closed or to a reduced income of at least 75% as stipulated in article 17 of Royal Decree-Law 8/2020, 17th March

- To be up to date in all State and Autonomous Region tax obligations as well as Social Security contributions

- To fulfil all obligations established under article 14 of General Grant Laws (Ley General de Subvenciones), which basically states the applicant meets all necessary requirements for said grant and can provide proof of this, can provide accounting books etc

- Is registered at under the Economic and Financial Registry of the Canarian Government (this can be done at the same time the application is processed if necessary)

- This grant is applicable to self-employed persons whose activity has been suspended in virtue of Royal Decree 463/2020, 14th March and for a maximum period of one and a half months from the date of the State of Emergency

- Upon applying, the applicant allows the Administration to verify their situation at Social Security, the National Tax Office etc., although the applicant can refuse this authorization, but they would then have to provide the necessary proof themselves

- The applicant must sign a Sworn Declaration stating whether they are in receipt of other grants, benefits etc as a result of the State of Emergency, or a declaration to the contrary saying they have not applied for or received other grants. Details of these other benefits/ grants must be provided

- All applications will be processed by the Administration in order of arrival

- The Administration will review the request and determine whether the applicant meets the requirements. They may also ask for additional documents to validate the application which much be provided within 10 days. If the paperwork is not received, the application will be automatically withdrawn

- The Administration must resolve applications within three months from the date of receipt. This deadline may be increased under extreme circumstances, but generally speaking, if the applicant is not notified within three months, it is understood the grant has not been approved due to administrative silence

- All applications must be sent and processed online via the Regional Employment Ministry (we’ll get to that later…)

- The amount due will be determined by applying 30% of the Base Rate payable to Social Security. If the applicant does not reach the minimum contribution period to qualify for “unemployment” under normal circumstances, the amount due will be the equivalent of 30% of the minimum Base Rate.

This last point was one of the concerns I highlighted in my previous article because the 2nd April Decree only referred to the grant being calculated on the minimum Base Rate, but many business owners contribute at a higher Base Rate. This issue has therefore been answered positively in this Order. Regarding the stipulation about not qualifying for unemployment, generally speaking and outside the current COVID-19 crisis, to qualify for sole trader unemployment, the applicant must have specifically contributed the concept of “unemployment” within the 48 months prior to closure of business and in an uninterrupted manner during the twelve months immediately prior to closure.

As can be expected, falsification of details or circumstances will be penalized by the return of any payment received as well as interest due and possible fines, however, the Administration has four years by law to reclaim, so the applicant must preserve all documents that refer to their entitlement to this grant for the same period of time.

IMPORTANT NOTE: The Decree and this Order refer to an initial fund of 11 million euros; this may be increased if necessary, but only if additional funds can be made available for this purpose, but as I mentioned previously, this grant is a “first come first served” operation, so if the funds are depleted and additional funds are not approved by the Government, any applications that are received once money runs out will be automatically rejected.

Now for the part I said we would get back to… The Order states that all applications must be sent and processed via the Regional Employment Ministry‘s online platform, but this morning I checked and the procedure has not been habilitated on their website yet and nothing has changed upon writing this article this evening. The Order was drafted on 21st April, officially released today and comes into effect from tomorrow, Tuesday 28th April 2020, so perhaps the platform will be ready by morning…?

In any case, this is a completely different application to the Central Government and it is payable in a single payment, so a message to my clients: Please email me, if you would like to apply for this additional grant so the applications can be prepared as soon as possible and filed the moment the Regional Employment Ministry updates their online platform to receive petitions. If you are not a client of this consultancy (why not?) and you applied for the Central Government benefit via your own accountant, I would recommend you contact them asap to get this application underway if you want to claim.

UPDATE 28/04/2020: In my previous article, I mentioned a few issues I had with the available information, and since last night, I have been thinking further about the Order and there are still queries/ concerns about the way the document has been drafted, namely:

1. The use of the word “grant” or “subsidy” instead of “Benefit” as the Central Government has done. This implies that any monies received must be declared as income next year on your Personal Tax Return for 2020

2. The official Summons or Notice is still pending publication on the Platform that is supposed to receive and process these applications

3. There are a couple of contradictions in the text; in one instance, a requirement is to be registered under the Social Security system on the date of the state of emergency and in the very next paragraph, they say the applicant must have cancelled registration of their business activity as a result of the activity being suspended by Royal Decree. This does not make sense because a requirement for those who receive benefits from the Central Government is to remain “active” on paper. The whole point of this is to try to prevent sole traders from closing their businesses permanently and laying off employees

4. Another contradiction is that one one hand, they refer to the grant being based on those affected as per Article 17 of Royal Decree-Law 8/2020. This article speaks about business owners whose activity was suspended due to the state of emergency, as well as those whose income has significantly decreased by at least 75%. However, in another portion of the Order, they state that business owners whose activity is not listed as one of those that were automatically do not qualify. This statement would therefore, exclude those who have suffered a lower income, so again, there seems to be a discrepancy

5. The Order talks about a single payment, however, benefits payable by the Central Government will continue for the duration of the state of emergency. Since this is supposed to be a complementary payment to make up 100% of the Base Rate, shouldn’t the payments continue in line with the Central Government’s?

Further information may be available over the next few days to clarify some of the details included in this Order, and most of the Decrees and Orders published since the State of Emergency began have been followed up with clarifications and corrections which may be the case here.

There have been whispers about the progressive lift of restrictions and the possibility of extending lockdown measures until the end of May, so I imagine further news will become available about that shortly too.